Tipalti is the platform ClickFunnels uses to handle affiliate payouts and manage required tax documentation. It supports accurate and timely payments to affiliates across different countries. This article explains how the Tipalti process works for ClickFunnels affiliates and what to expect when setting up your account.

Requirements

What is Tipalti?

Tipalti is a third-party platform that automates the entire supplier payments operation. It helps businesses manage their accounts payable processes efficiently by streamlining invoice processing, tax compliance, payment reconciliation, and supplier communication. Tipalti provides features such as invoice processing, payment automation, global payment capabilities, tax compliance management, supplier onboarding, and reporting and analytics.

ClickFunnels uses Tipalti to organize tax documents and distribute payments to our affiliates on the 1st and 15th of each month per our payout guidelines. Once you earn your first commission, you'll be prompted to complete the Tipalti setup. To receive payment, your Tipalti account must be fully completed within 120 days of that first commission. This is required regardless of your country of residence; otherwise, your earnings will expire.

The three main parts to setting up your Tipalti Account are:

Personal Information

Tax Documents

Payment Method

Tipalti Account Setup

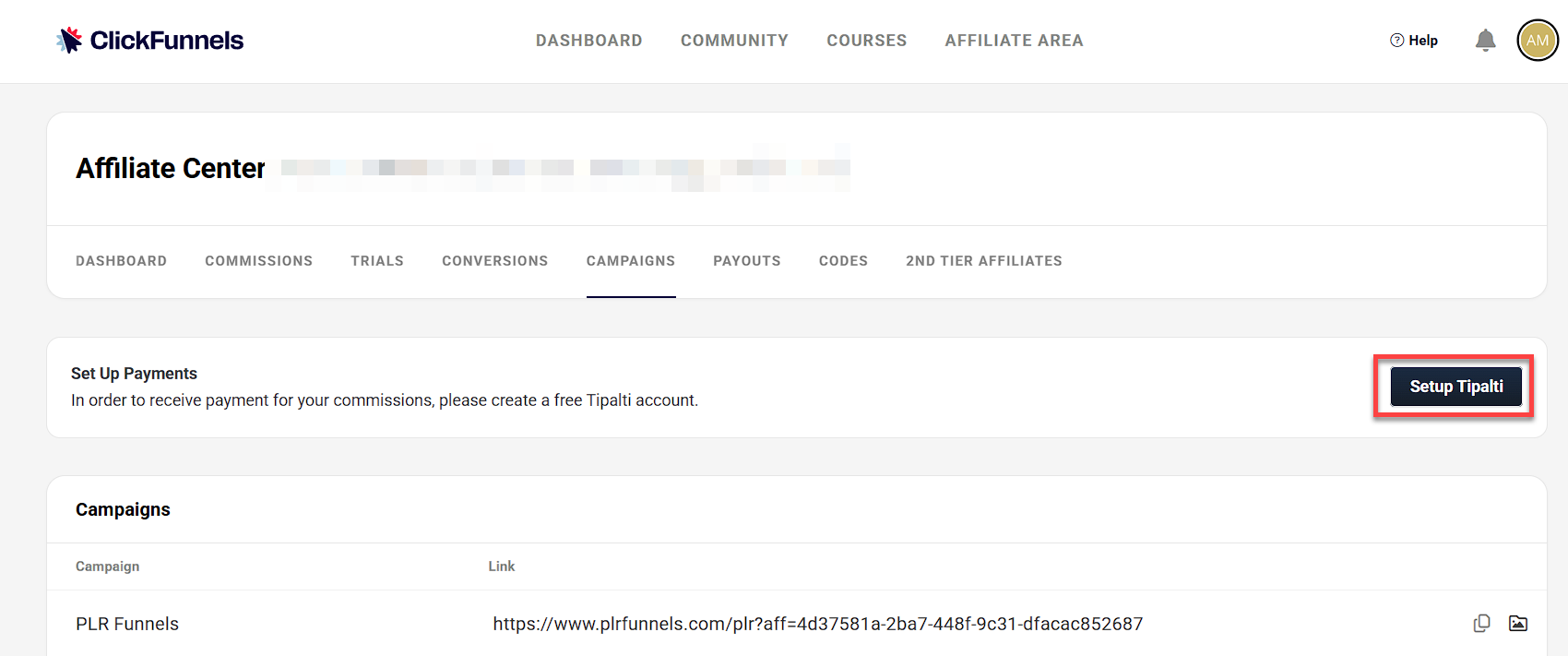

Open your Affiliate Dashboard to begin the setup process. If you're a ClickFunnels user, access it from the CF2 Affiliate Center in your workspace menu or through the Referrals app. If you're an external affiliate, log in through the Customer Center, then click Affiliate Program and select Affiliate Dashboard.

Click Setup Tipalti.

You will be prompted to provide:

Address

Payment Method

Tax Forms

The options available for Payment Methods are country-dependent. You can view the list of available methods by country to see which ones apply to your location. Commonly supported options include:

Wire Transfer

Global ACH / Local Bank Transfer

Check

PayPal

Intercash

Once you complete this process, most US-based individuals or businesses will be confirmed "on the spot," and your Tipalti account will be immediately deemed as payable.

Non-US locations may require alternate tax documentation and could require additional verification before receiving the "Payable" tag.

Once your account is set as payable, you will be eligible to receive payouts on the 1st and 15th of each month as long as you meet our payout requirements.

Helpful Resources:

Tipalti FAQ

What is the 120-day Commissions Expiration?

If you do not set up your Tipalti account in those 120 days, your commissions will be expired. You will be deemed to have permanently waived and forfeited all rights to Commissions that were earned more than 120 days before submitting a completed W-8 or W-9 tax form or any ancillary supporting documentation that is requested to confirm the information on your tax form.

How do I fill out my Tipalti forms?

Once you earn your first commission, you’ll be prompted to complete your Tipalti setup in the Affiliate Dashboard.

To complete the setup, click Setup Tipalti and follow the guided steps. You’ll be asked to enter your personal details, tax information, and preferred payment method. Once finished, your account will be reviewed and marked as payable if all requirements are met.

Which type of tax form should I fill?

Due to policies in place, we are not able to provide you with any advice related to the tax forms. If you have questions, it is recommended that you reach out to a Tax professional however, you can review more information regarding which tax form will be best suited for you depending on your region here - https://support.tipalti.com/Content/Topics/UserGuide/Taxation/TaxWithholding/TaxFormEntityTypes.htm?Highlight=tax

What are the different tax forms available?

W-9 is for US Citizens, W-8BEN is for non-U.S. Citizens, and W-8BEN-E is for foreign business entities.

I cannot log in to Tipalti

Please go to https://suppliers.tipalti.com/clickfunnels/account/login and attempt to request a password reset. If you continue to have trouble logging in, please reach out to our support at support@clickfunnels.com.

I need to submit new tax forms

Please log into your Tipalti account to update your tax forms. You can log in by going to: https://suppliers.tipalti.com/clickfunnels/account/login

How long will it take me to be approved?

Generally, our US-based affiliates that fill out a W9 could be approved almost immediately after submitting their tax forms. Our international affiliates can take a bit longer since they may need to submit additional forms and wait for those forms to be approved.

How to Delete my Tipalti Account

Please reach out to Tipalti to delete your personal details if you want to delete your account.

How to reset my Tipalti account password

Head over to https://suppliers.tipalti.com/clickfunnels/account/login and request a password reset. If you continue to have trouble, please reach out to our support!

My number changed for the 2FA authentication. What do I do?

Please reach out to support so we can reset your 2FA which would allow you to set it up with your new number the next time you log in.